No Warning. No Mercy. New Rules.

04/28/25 The Monday Blueprint: Markets cracked, confidence snapped, and the new game is already halfway played. If you've been waiting for a sign to move—this is it. Burn the plan. Build the thing.

I’ll be holding open office hours this Tuesday at Breakaway Café from 10 AM to 1 PM. Schedule something official—or just walk in, grab a coffee, and drop into the chaos with me.

Confidence cracked. Markets broke. And it happened fast. No monster at the door. No slow-motion unraveling. Just a hard snap—and a new game already underway. And that's where we are now.

Tactically?

If you’ve been sitting on a plan, a project, a maybe-someday dream you thought had to wait?

Maybe it doesn’t.

Maybe this is the moment to stop waiting. Pause the plan. Burn it down. Build the damn thing now.

Let me be your first phone call. Or just come grab a coffee. No pressure. No sales. Just an open seat—and a one-on-one strategy session to help you figure out your next move.

LAST WEEK IN THE STOCK MARKET:

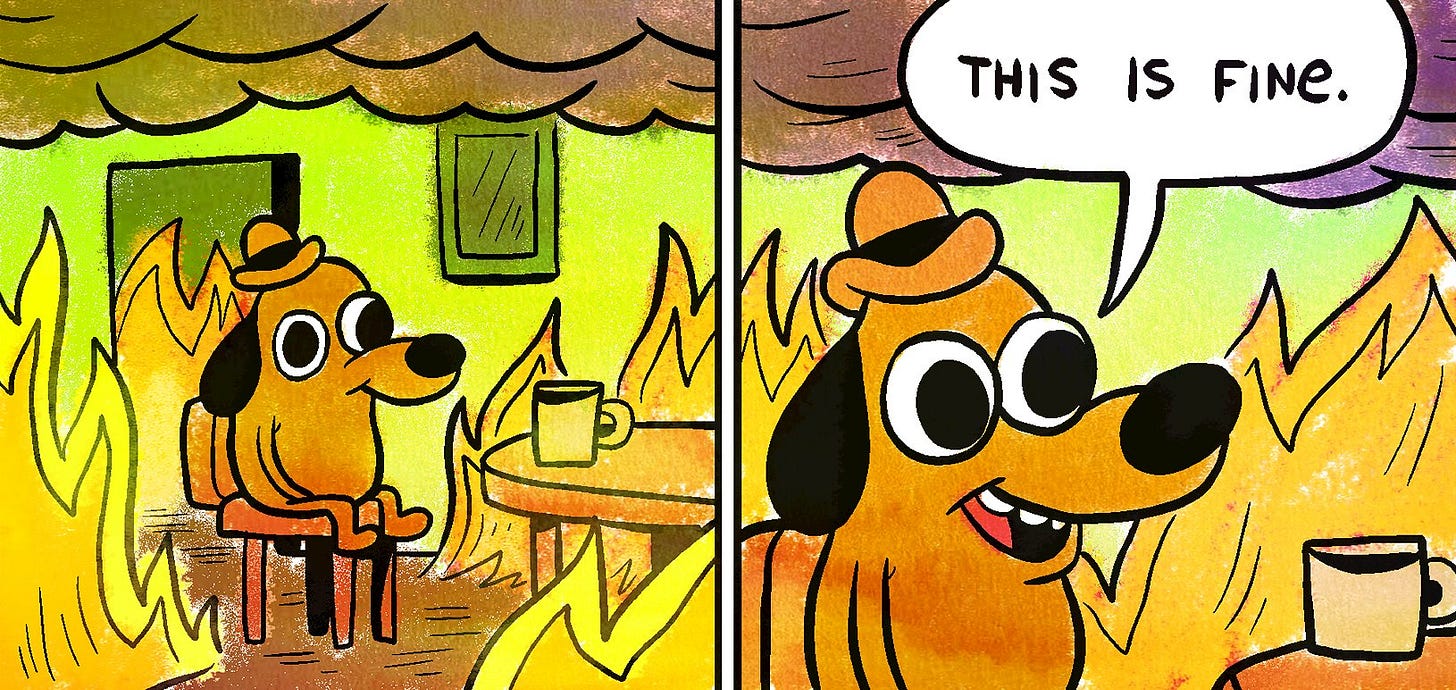

No exits and no safe selloff here. The fire’s so hot, even the safety belts are melting.

What started as a few bad earnings reports and tariff threats has turned into tripping over shoelaces, scrambling to find all the exits while the house is on fire. Meanwhile, Trump saying everything is fine—that we just got the yips—he’ll just cut taxes to help out at the grocery store.

The supposed safety nets—the Magnificent Seven tech stocks like Tesla, Nvidia, and Palantir—faceplanted. Hard. The S&P 500 dropped nearly 10%, the Dow lost 8%, and the Nasdaq officially entered a bear market. Even Bitcoin flinched. Confidence slid face-first across the pavement.

Corporate and small business costs are surging, and Jerome Powell’s Federal Reserve is caught between a political bullhorn and an inflation problem that won't die. Earnings calls have turned into a cautious whisper parade while stuffing as much cash into the company basement as possible.

S&P Futures: 5,257.00 (▼ -1.05%)

Dow Futures: 38,971.00 (▼ -0.91%)

Nasdaq Futures: 18,168.75 (▼ -1.15%)

Russell 2000: 1,874.20 (▼ -0.81%)

Gold’s moving up as investors look for shelter. And the VIX—Wall Street’s so-called "fear gauge" that tracks volatility—is climbing too, flashing early warning signs that traders are paying for protection against even bigger market swings. Translation: when the VIX rises, people are nervous enough to start buying financial seatbelts.

Big Themes to Watch:

1. The Shadow Economy Is Breaking into the Open

The official numbers still say things are "okay," but everywhere you look, the workarounds are getting louder. Families stretching groceries two extra weeks. Businesses paying in advance to dodge future price hikes. Prime Day sellers bailing to protect margins. Real-world spending habits are flashing recession warnings before the charts catch up. The economy isn’t collapsing—it’s morphing into something Washington can't measure.

➡️ Watch for: A surge in off-market trades, used goods spikes, cash-heavy transactions, and DIY repairs booming across consumer sectors. If it feels like 2009 backyard barter system energy—you’re not wrong.

2. Energy Markets Are Playing Chicken—and Losing

Oil’s dropping, but it’s not a gift. It’s a warning. OPEC+ is pumping more to claw back revenue, while US shale rigs quietly pack up and go home. Meanwhile, Iran is stirring the pot, and global shipping chokepoints are flashing risk lights. Cheap gas at the pump might be the most expensive mirage we see all year.

➡️ Watch for: Oil dipping toward $55 and snapping back violently. Strategic Petroleum Reserve buys reappearing. Shipping premiums climbing. And energy executives tiptoeing around the word "glut" on earnings calls.

3. China’s Playing the Long Game—and It’s Working

While U.S. headlines whiplash between tax cuts and tariffs, China’s strategy hasn’t changed: prop up exporters, lock down critical tech sectors, and build an economic firewall. Every signal out of Beijing right now screams: survive the tantrum, then dominate the recovery.

➡️ Watch for: Massive Chinese export subsidies masked as "domestic aid," state-backed AI development speeding up, and U.S. companies getting squeezed in Asia as quietly as possible.

4. Wall Street’s Rally is Built on Shrinking Ice

The past month’s bounce wasn’t a rally. It was a sigh of relief that tariffs weren’t worse—yet. But every positive day has been narrower, thinner, propped up by fewer and fewer names. Breadth is dying. Fundamentals are fraying. And traders are playing musical chairs with one eye already on the door.

➡️ Watch for: Fewer stocks driving gains. Junk bond yields creeping higher. Defensive sectors (healthcare, utilities) suddenly outperforming. And big funds prepping "liquidity exit plans" behind the scenes.

Looking Ahead:

1. April 30—PCE Inflation Report: The Real Grocery Bill Lands

On Tuesday, the Fed’s preferred inflation gauge—the Personal Consumption Expenditures (PCE) index—drops. Normally a snoozer, but not this time. This is the first real test of whether tariffs are starting to wedge their way into core consumer prices. If PCE sticks or creeps higher? Kiss rate-cut dreams goodbye for a while. And maybe start budgeting an extra $50 for your next Aldi run.

2. May 1—FOMC Meeting: Powell’s Tightrope Act

On Wednesday, the Fed drops its interest rate decision and Powell holds a press conference that’s basically an economic hostage negotiation. Rates probably stay put, but the language will be surgical: every word about growth, tariffs, inflation, and “patience” will get picked apart like prophecy. If Powell wobbles even a little? Markets will swing—and not in the fun rollercoaster way.

3. May 3—April Jobs Report: Labor’s First Limp?

Friday brings the April employment numbers. On paper, jobs are still holding up. But cracks are showing: Amazon sellers are pulling out, small business hiring is slowing, and big corporates are already freezing headcount behind the scenes. If nonfarm payrolls dip below expectations, or wage growth stalls, the "soft landing" narrative could start circling the drain.

4. May 5—OPEC+ Meeting: The Oil Chessboard Shifts

Sunday, the OPEC+ cartel huddles to figure out whether to keep pumping oil into a market that’s already coughing up $60 barrels. Trump’s cheap-oil pressure and falling global demand have the Saudis stuck between trying to save face and trying to save money. One wrong move? Oil prices could either collapse another 10 bucks or spike 20 overnight. No middle ground.

OUR FEATURED BUSINESS