Penguins, Popcorn, and the End of Decimal Points

04/07/25 The Monday Blueprint: Your teenager's popcorn budget is now the new leading economic indicator as Hollywood prays Minecraft can save the box office and tariffs hit actual penguins.

Why the U.S. Just Declared War on Penguins

For me, it was the penguins. Or more precisely: a 10% U.S. import tariff on Heard and McDonald Islands—a desolate, lava-oozing, UNESCO-protected penguin colony in the sub-Antarctic with no exports, no inhabitants, and no obvious reason to be lumped into global trade policy alongside China and the EU. That one bizarre data point cracked something open. Because Heard and McDonald weren’t the only ghosts on the tariff list.

This is Part One of a four-part investigation into the Penguin Tariff, what it hides, and who it benefits:

Part One: Penguins, Decimals, and AI-Generated Trade Policy

How weird math, suspiciously clean numbers, and an eerily ChatGPT-esque formula might suggest the first policy designed not by AI, but to look like it was.Part Two: The Wire Beneath the Waves

We’ll dive deep (literally) into the undersea cable routes, satellite ground stations, and obscure geopolitical choke points that link these islands—not to penguins, but to power.Part Three: The Paper Islands

A forensic look at tax havens, shell companies, and money laundering networks embedded within these remote territories. These places aren’t empty—they’re useful.Part Four: The Why

What if the tariffs aren’t about trade at all? We’ll explore how tariff codes act as soft sanctions, signal flares, and legal scaffolding for something far more calculated—and far more dangerous.

So no—I’m not saying it’s aliens. I’m not saying it’s AI. But I am saying: start paying attention to where the wire touches the ocean floor.

I’m always up for a good conspiracy theory. Flat Earth? Absolutely. Lizard people in the Denver Airport? I’ve been there, so please tell me more. Alien abductions? Almost the best genre nonfiction aside from Bigfoot. I’ve got a soft spot for the beautifully unprovable—especially the ones where truth might be weirder than theory.

So when the news dropped that the U.S. government slapped a 10% import tariff on penguins, I leaned in. Because something about that felt… off.

Heard and McDonald—two icy, uninhabited blips on the map about 2,500 miles southwest of Perth, Australia. You can’t fly there. You can’t book a cruise. The only way to reach them is a seven-day boat ride through brutal waters, which a few amateur radio nerds did back in 2016, sent out some random Morse code, and then left. Nobody lives there because nobody can live there. A volcano regularly leaks lava down its glacial flanks. Elephant seals rule. And then there are the penguins. Hundreds of thousands of penguins. Basically, ice, steam, and feathers. These islands are nature’s middle finger to civilization.

And yet, somehow, this ecological no-man’s-land—UNESCO-protected, untouched, functionally silent in terms of exports—got dropped into the same trade policy framework as China and the EU.

But Heard and McDonald were not the only weird locations that got tariff-fined.

Norfolk Island, population approximately 2,200 people

Christmas Island known mostly for red crab migrations

Svalbard an international science outpost

Cocos Islands mostly just a random airplane runway and some coral.

And the Falkland Islands, a frozen Cold War relic.

In fact, even in the Cold War, I don’t know how much importance the Falkland Islands even really played back then. Other than bruised pride and needless deaths. But if you’ve forgotten--

In 1982, Argentina invaded the British Overseas Territory in the South Atlantic, claiming Sovereignty. Britain, led by Margaret Thatcher, sent a naval task force to kick the Argentinians out. Ships sunk, lives lost—a full-blown war where Britain won and Thatcher’s popularity soared.

But since then? The Falkland Islands are still British. Argentina, though still claims them. And besides wool and fish sent to the EU, the Falklands are economically irrelevant. No major tech. No real connection to U.S. supply chains. Just cold, windy nationalism. I mean, seriously, the only people who keep the Falklands top of mind in 2025 are either British right-wing nationalists with a Thatcher shrine or still pissed-off Argentine nationalists.

So why are the Falklands and a penguin preserve on the tariff list? Elephant seals aren’t secretly funneling lithium to Beijing.

I also have serious questions about the numbers. I can clearly see a 10% baseline tariff on all imports. But China at 34%, EU 20%, Japan 24%, South Korea 25%. I’m amazed how easily whole these percentages are. If you go all the way back to 1832, we see nearly all imports tariffed at 95.5% and additional duties at 43.2%. The Smoot-Hawley Tariff Act of 1930 saw 19.2% tariffs. Of course, tariffs fell in the 1980s and 90s, but you still had the decimals.

1980: 1.4%

1985: 1.6%

1989: 3.91%

1990: 3.92%

1995: 2.94%

1999: 2.31%

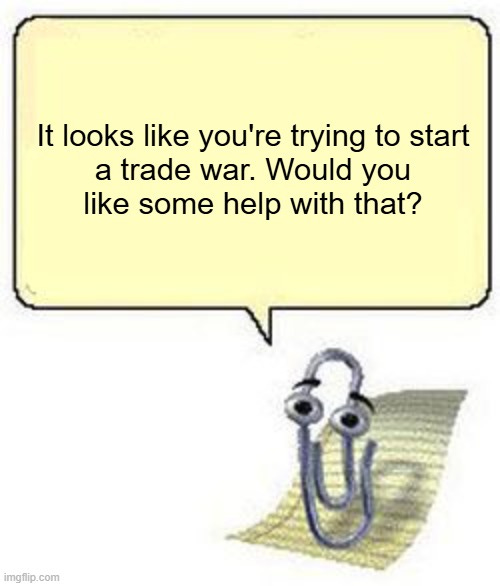

So why the sudden round-number renaissance? Trump’s tariff numbers are too clean because tariff policy emerges from messy negotiations, compromises, lobbyists fighting over fractions. Even during America’s most aggressive trade moments—1830s protectionism, Depression-era panic, Reagan’s trade balancing act—we still dealt in decimals. Decimals are the fingerprints of negotiation. They’re where lobbyists live. When everything ends in zero, someone erased the fingerprints. And the whole numbers game feels like a simple high school algebra problem because the actual math Trade deficit ÷ exports × 0.5 = tariff is like Econ 101 taught by Clippy.

The more you look at Trump’s tariff thing, the more it reads like someone fed a spreadsheet into a policy blender and just hit puree. And maybe that’s exactly what happened because then I ran into Nate B. Jones. He’s sitting back in his office, flannelled and knit cap hat, heavy nerd glasses, and he just says the thing I’ve been thinking, but too scared (or rather too worried to say out loud).

What if these tariffs weren’t designed by humans at all?

What if they were generated—copied directly from an AI model like ChatGPT or Claude or Gemini?

Jones makes his case: every major large language model, when asked how to fix a trade imbalance, spits out the exact same flawed math. They all mistake trade deficits for tariffs. They all use the same “divide and halve” logic. And that’s the same formula baked into this policy.

It’s not definitive. It’s not proof. For my college composition fans, this is certainly correlation without causality, what 90% of all good conspiracy theories are based upon.

And if we’ve lost the decimals, maybe we’ve lost the humans.

But look, so far I’m not saying anything new here. Dominic Preston on the Verge, Theo Burman for Newsweek, Victor Tangermann at Futurism, Thomas Maxwell on Gizmodo, Stan Schroeder at Mashable, and Marina Hyde for The Guardian. And I think—my conspirator hamster doing double time in the brain wheel here—the missing decimals, the seemingly lazy AI math is a cover.

Let’s go deeper. Because every one of those strange little islands—Christmas, Cocos, Falklands—has something in common. They’re geostrategic footnotes with outsized importance for anyone watching the digital map instead of the physical one. They’re British Overseas Territories, mostly with military, surveillance, or data routing potential, all below the public radar. And some of these under-the-radar locations on the tariff list happen to

sit on critical undersea cable routes

have satellite ground stations

be tax havens or shell company hubs

be historically tied to British intelligence operations.

And Trump’s first week in office included withdrawing from WHO, restoring loyalty oaths, reclassifying civil servants, and a hiring freeze, which means fewer people to notice. Fewer watchdogs. Fewer hands on deck. And now you’ve got yourself a policy shaped to look machine-generated by people who know exactly what they are doing.

What we have is quiet, systemic, old-school power in new drag. Tariffing undersea cable choke points is geopolitical leverage. Hitting shell-haven islands with zero exports, that’s straight-up message-sending to laundering networks. Putting the Falklands on the list? That’s just poking Britain in the ribs while wearing clown shoes because we can. But this AI gloss? That’s our smokescreen. The kind of bullshit that makes journalists roll their eyes and doomscroll on past instead of pulling the thread.

I’m not saying it’s aliens.

I’m not saying it’s AI.

I am saying, look where the wire touches the ocean floor and look hard at who owns those cables, because if you think this is just a penguin tax, you won’t dive any deeper.

Other References:

https://www.bbc.com/news/articles/cly8xlj0485o

https://en.wikipedia.org/wiki/History_of_tariffs_in_the_United_States?

https://en.wikipedia.org/wiki/Excise_tax_in_the_United_States?

https://en.wikipedia.org/wiki/1983_motorcycle_tariff?

https://en.wikipedia.org/wiki/Portugal%27s_list_of_tax_havens

LAST WEEK IN THE STOCK MARKET:

Hollywood begs for popcorn money, and families start budgeting like central banks.

Two weeks ago, we were just tiptoeing down the hallway, ears pressed to the door. Then last week, something creaked—that moment in the horror movie when the doorknob slowly turns and everyone freezes.

And now?

That door is open.

Not kicked in. Not blown off the hinges. Just… open.

Wide enough for cold air to spill into the room.

Wide enough for the markets to look inside the whisper,

That’s not supposed to be there.

The Dow dropped 8%.

The Nasdaq officially entered a bear market.

The S&P 500 lost nearly 10%.

The Magificient Seven face-planted (again) and no one’s laughing.

Even gold flinched.

Bitcoin blinked.

Powell stood at the mic and said, “It’s too early to say.”

Big Themes to Watch:

1. Sentiment Breaks Before the System Does

The surface still looks okay—jobs are holding, inflation is cooling (sort of), and the Fed hasn’t screamed yet. But people are unraveling. Consumer confidence is tanking. Business optimism is deteriorating. Everyone feels like something’s off, and even the numbers haven’t caught up to that vibe. It’s not a recession yet. But it’s starting to feel like the kind of panic people only feel before one begins.

➡️ Watch for: Discretionary spending to fall off a cliff, early signs of hiring freezes, and CFOs quietly pulling back capital expenditures.

2. The Return of Gravity: Grown Stocks Lose Their Cloak

The Magnificent Seven aren’t just blinking. They’re bleeding. Tesla, Palantir, Nvidia, NIO, even Apple. These were supposed to be the stabilizers, the floaties in the deep end. But now they’re just lead weights. Investors are remembering that valuation actually matters.

➡️ Watch for: Capital rotation into utilities, commodities, and weirdly… Europe. Big tech guidance downgrades ahead of earnings. And some very awkward interviews on CNBC.

3. Corporate Earnings as a Blood Test

Q1 earnings season kicks off this week, and the truth is about to come out. Most of the results won’t include full tariff impact—but the guidance will. And guidance is where companies whisper what they’re really seeing.

➡️ Watch for: Big banks playing defense on loan loss provisions. Retailers hinting at inventory issues. CEOs saying “macro headwinds” way more than usual.

4. The Consumer Gets Cubanized

In the auto market and beyond, people are holding onto things longer. We’re seeing early signs of the Cubanization of consumer culture with fewer upgrades, older assets being maintained not replaced, and supply chain distortions hitting availability and affordability. I probably need a new computer, by the way, but I just ordered a bunch of replacement parts and over the next several days you can expect some heavy cussing emerging from my office space as I tear apart the case and perform DIY repairs.

➡️ Watch for: A bump in used goods markets. Declines in new car sales. And a broader cultural shift where maintenance becomes a form of resistance. Dust off your Facebook Marketplace walking shoes is all I’m saying.

Looking Ahead:

1. April 9 – The Tariff Clock Hits Zero

Trump’s latest round of tariffs officially kicks in Wednesday. If companies haven’t already raised prices or pulled back orders, they’re about to. Supply chains will seize. Importers will panic. Retailers will quietly start rewriting their summer forecasts. And just when I was getting into Lady Mechanika.

2. March CPI Drops—But it Might Not Matter

The Consumer Price Index hits Thursday morning, and under normal circumstances, this would be the headline. But right now, the CPI is probably more like yesterday’s weather report. Markets want proof inflation is slowing, but they also want to know if the tariffs are about to yank prices back up. Even a soft CPI print may get overshadowed by the freight train everyone sees barreling down the tracks.

3. FOMC Minutes—The Fed Reads the Room

The Fed’s meeting minutes from March drop mid-week, and they’ll be parsed like ancient prophecy scrolls. Did they anticipate this tariff tantrum? Did they have internal models showing instability? Were they worried or just patient? Whether the signs already pointed to a pivot—or the Fed didn’t see any of this coming—either possibility could shake the room.

4. IPO Market on Ice: Watch Who Pulls Out Next

Newsmax soared, CoreWeave popped—and then it all went very quiet.

Multiple IPOs paused this week, including StubHub, eToro, and Klarna. Investors have gone from “what’s the valuation?” to “what’s the exit strategy?” The capital markets aren’t just cooling. They’re ghosting. Probably expect delayed filings, pulled roadshows, and tech unicorns searching for private lifeboats instead of public debuts.

In other economic news, my youngest kid went to see the new Minecraft movie. Jack Black, blocky pixels, and a theater full of teens half-hyped on Five Below candy smuggled in beneath sweatshirts. She still purchased the movie theater popcorn, because really half the point of going to the movies is the crappy cholesterol+ popcorn.

Earlier in the week, she bitched cause there was no food in the house for after school snacks. The no-food was a combination of factors. One, my ongoing ankle recovery. I’ve always been the one to do the grocery shopping and for my wife to take time out on a Saturday to get groceries—that’s not much to ask, but because of the habits and rhythms that have grown from the years of marriage.

The other issue was we didn’t have the cash. I mean, yes, we had cash, but our food budget had been decimated. We were waiting for that next paycheck to replenish the envelope.

"I’m thinking about running down to Dover Delite for a snack, but I only have $80 left, and I have the Minecraft movie coming up with my friends.” I certainly caved. Gave her my card.

She started the week with $100. And she budgeted like a Fed rate decision.

$10 for a Steam game she swears was on sale

$8 for smuggled into the theater Five Below junk food

$20 for the movie ticket

$19 for a small popcorn and Pepsi

$15.49 for the post-movie Minecraft McDonald’s meal.

And here’s the kicker: Hollywood needs that $100.

Tariffs are here, and they're already squeezing licensing margins, and the fallout is already hitting Hollywood. The margin for magic is shrinking. Ad budgets are shrinking, licensing deals are cracking, and content budgets are getting slashed. Streaming is buckling under churn. Box office projections for 2025 have been revised down. A Minecraft Movie isn’t just a movie—it’s a canary in a coal mine made of voxels.

Family films like this are supposed to be the safe bets. And sure, Minecraft pulled in a blockbuster $157 million opening weekend—the biggest domestic debut of the year, and the best in history for a video game adaptation. But the pressure behind that number is enormous.

Studios need a win. And family-friendly, franchise-driven IP like Minecraft is what they’re banking on. It’s cheaper than a concert, more communal than a phone screen, and—at least for now—still feels like a night out.

Even if it costs a teenager her snack fund, a third of her weekend budget, and the last of her Five Below stash.

Meanwhile, I went grocery shopping for the first time since before December, and $140 later, my Aldi cart was full. But just a couple of years ago, that same cart would have cost $70. And I didn’t even buy orange juice this time around.

By the way, during the Great Depression, when the economy flatlined, jobs evaporated, and breadlines stretched for blocks, Hollywood boomed. People bought lipstick and movie tickets. Escapism wasn’t a luxury; it was a need. Theaters were packed. Stars were born. And now, Hollywood churns out reboots like a factory with broken taste buds. We don’t need another Spiderman movie, and we don’t need another Superman.

You know, my kid even said A Minecraft Movie was bad. She said she knew the film would be bad going into it, but it wasn’t the film that was the point. But it was the camaraderie, the shared gasp and collective laugh. The whole row of seats leaning forward together when the hero makes a terrible choice—or in this case, with Minecraft, a meme-able moment.

Now? Nearly a 100 years out from the Great Depression, we’re once again staring down economic smoke and market panic, what the experts are calling a potential global recession, and the market doesn’t need more money—it needs meaning. Because if you’re asking families to trade in their Five Below snack fund, their Aldi cart budget, their maybe-I-shouldn’t-rent-it movie night hesitation… you better give them a reason that’s more than just IP with barely a pulse.