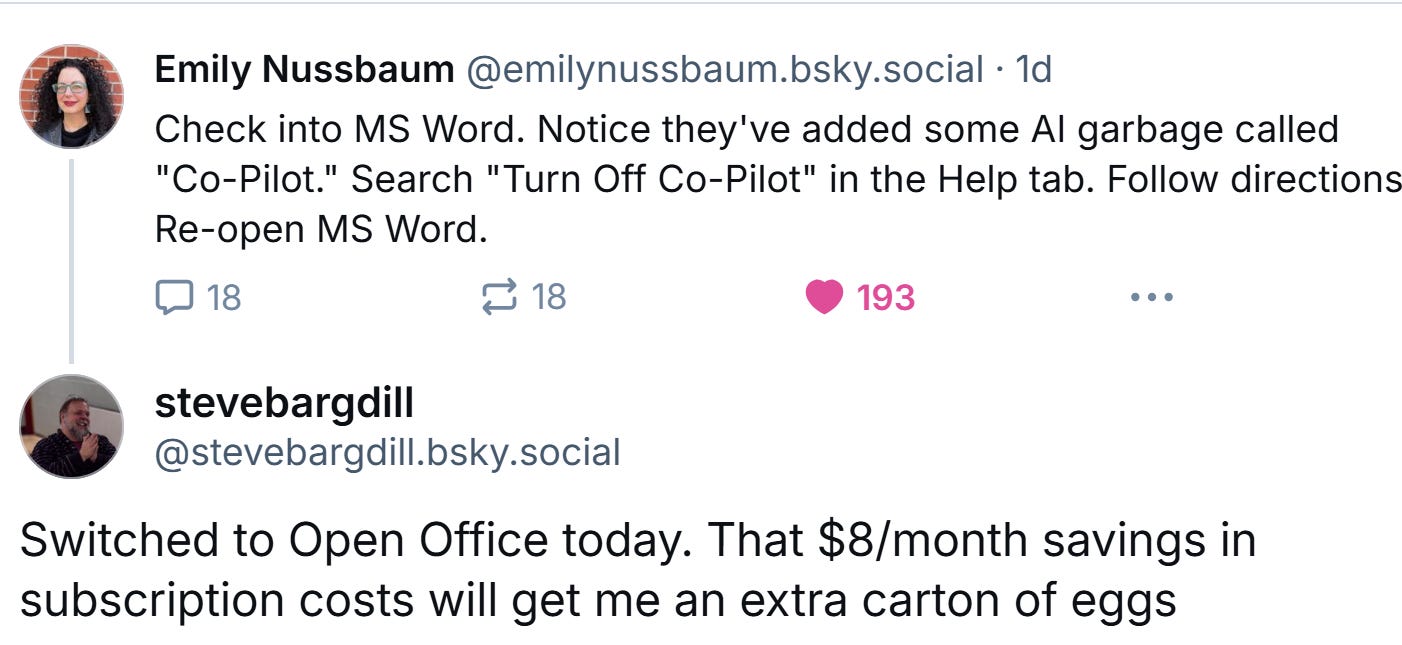

My transition to Open Office is now officially endorsed by a Pulitzer Prize-winning critic

The Monday Blueprint 2.10.25: Essays I've read and last week's market report

Here are some financial resources for wildfire victims.

Emily Nussbaum recently posted about opening Microsoft Word, seeing a new AI tool called Co-Pilot, searching for how to turn it off, and doing just that. This felt familiar because I had just canceled my Microsoft 365 subscription, downloaded Open Office, and saved myself eight bucks a month. Which, in today’s economy, means I can afford an extra carton of eggs.

It’s not just Microsoft, though. Every service, every software, every tool I use is quietly taking its cut. Business accounting software costs me $90 a month. Our personal finance software? Another $99 a year. Email clients, writing tools, platforms promising to make my life easier (Todoist, I’m looking at you, kid)—each with its own price tag, each a tiny decision I have to justify.

Some of these subscriptions earn their keep. I spend twenty dollars a month on ChatGPT, and it’s a decent investment. It’s an amazing brainstorming machine, helps me with some of the more tedious, mundane tasks related to writing, and quickly analyzes massive spreadsheets of information downloaded from the MLS.

The MLS, by the way, is another subscription-based tool that costs money. Once, I was sitting in my favorite coffee shop, and a fellow Realtor saw my computer screen set to Zillow.

“What the heck are you doing on Zillow?” he asked.

“Looking for houses.”

“Why not the MLS?”

Because I have to log in, click seven different buttons, put in my search parameters, and on and on. Plus, the MLS site feels like navigating a website designed in 1979.

So for me, ChatGPT seems worth the cost, but I wonder sometimes if the app is really all that life-changing. Is it actually saving me time, or just changing how I spend it? We keep being told that AI will automate the boring stuff, free us from tedium. But so far, the tedium just seems to be rearranged into new, slightly more novel shapes.

I miss the days of WordPerfect 5.1, pirated off my university’s computers, of course. The flat blue screen with the pixelated gray blinking cursor in the upper left-hand corner. My friend hauled over a stack of 3.5” floppy disks, and we installed the software on my dad’s computer like some kind of secret weapon. We watched each loading screen with Mountain Dew and a bag of Doritos.

Mailchimp cost me $145 a month. Substack, by the way, is free and does the same thing as Mailchimp. Plus, Substack’s algorithm actively pushes my writing out into the world. Mailbird, I thought, would solve my email woes, and I stopped caring about how LinkedIn Premium allowed me to theoretically stalk people better.

Every platform wants me to subscribe, to verify, to pay a little more for slightly better access.

This essay isn’t about being mad at Microsoft or LinkedIn or Mailbird. What I’m realizing these days is how much these small expenses add up, how we justify them, and how, despite all the promises of streamlining and convenience, most of these software-as-a-service expenses simply shift the inefficiencies around. You save $8 here, but the real issue isn’t just the money—it’s the constant recalibration of what’s actually useful.

The quiet, ongoing practice of figuring out what matters involves determining what’s worth keeping, what’s worth dropping, and what feels good to pay for versus what slowly siphons away joy.

I Need Your Help—Right Now

I believe the work I do—exposing these stories, building communities, connecting people—matters. And if you’re reading this, I’m asking you directly: help me keep going.

🔹 You can support me on Substack, sure. Every subscription fuels this work.

🔹 But if you really want to make an impact—refer someone to me for real estate. No matter where you are in the world—Timbuktu, Tokyo, Toronto—if you know someone thinking about buying or selling real estate, connect us.

My real estate work directly funds everything I do—my writing, my advocacy, my community building. If what I do matters to you, that’s how you can support me.

IN NO PARTICULAR ORDER

Essays I’ve Read

The Big Picture*

Emily Nussbaum’s introduction to I Like to Watch, titled The Big Picture: How Buffy the Vampire Slayer Turned Me Into a TV Critic, isn’t just an argument for the artistic merit of television—it’s a love letter to the way TV embeds itself in our personal histories. She doesn’t just analyze pop culture; she maps its emotional and intellectual terrain, making the case that the small screen has always been as grand as any other form of storytelling.

The opening lines of this essay set the tone: Buffy the Vampire Slayer wasn’t just a campy teen show; it was a subversion of the horror genre’s helpless female victim. “As he would often explain in interviews, Whedon had taken the bimbo victim of every exploitation film—the eye candy, tottering to her death down a dark alley—and let her spin around and become the avenger,” Nussbaum writes. And it’s that spin—the transformation of something dismissed as lowbrow into something mythic—that defines both Buffy and Nussbaum’s entire approach to criticism.

What makes this essay so relatable is how effortlessly it taps into nostalgia. As someone who grew up physically turning the TV dial for my parents, back when there were only four channels to choose from, I get it. TV wasn’t just something we watched—it was something we experienced communally. When my wife and I first married, ER was our ritual, and our discussions about episodes felt just as urgent as the drama unfolding on screen. That’s the essence of The Big Picture: TV isn’t just entertainment; it’s the background music to our lives, shaping how we think, talk, and relate to one another.

Where I initially diverged from Nussbaum was on Buffy itself. I thought the TV show ruined the film—at least, that was my teenage take. I saw the series as diluting something quirky and self-contained into a drawn-out CW drama. But over the years, I’ve met so many women who felt empowered by Buffy, and I’ve come to appreciate what Nussbaum sees. Buffy wasn’t just a campy show; it was a generational touchstone, a reframing of female strength.

What The Big Picture does brilliantly is argue for television as mythology. Nussbaum doesn’t just review shows—she examines how they function in our cultural consciousness. She reminds us that TV, long dismissed as lesser than film or literature, has always been a serious art form. And, more importantly, that it has always been personal.

The nostalgic pull of The Big Picture is one I don’t want to escape from.

*Yes, I reviewed the essay because she liked my Bluesky post.

Oppose Oposse Oppose

Paul Krugman’s Oppose, Oppose, Oppose — and Do It Loudly is, in essence, a call to arms for Democrats and Trump opponents in the wake of the 2024 election. It’s a polemic wrapped in political strategy, built on historical precedent, economic analysis, and a not-so-subtle jab at the media's role in "sanewashing" Trump. Krugman doesn’t pull punches—this is not an article seeking middle ground or offering a bipartisan path forward. Instead, it’s a full-throated (for Krugman) rejection of any notion that Trump’s victory confers a sweeping mandate and an urgent plea (for Krugman) for the opposition to resist at full volume.

Despite the title's exclamation—Oppose, Oppose, Oppose!—Krugman doesn’t actually write in a frantic or fiery tone. His voice is measured, intellectual, and often dryly amused, as if he’s explaining something obvious over a glass of scotch rather than rallying the troops on a barricade. It’s part of what makes him effective—he’s not a screamer. He’s a professor, and I rather imagine him in a loung barker waiving around a loose fist and in the other hand holding a glass of slow scotch while he explains why something is both inevitable and absurd.

That’s probably why his writing holds up better over time than a lot of hot-take opinion columns—it’s urgent in content but never in delivery.

A Letter From a Birmingham Jail (1963)

The I Have a Dream Speech is good, but represents Martin Luther King, Jr polished, performative, and tailored for mass consumption. Letter from a Birmingham Jail is real persuasion, layerd, methodical, deeply peronal, and completely uncompromising in moral logic.

The Birmingham letter was in reponse to “A Call for Unity,” a 500-wordish statement that politely and carefully rebuked King and the civil rights demonstration happening in Birhmingham. They said the demonstrations were “unwise and untimely” and they argued while raial inustices existed, civil rights activites should rely on negotiations and the courts rather than public protests. They called for patience and gradual change.

King used the clergymen’s own words as a launching point for one one of the most methodically structured defenses of direct action, moral law, and civil disobedience. The letter works as personal manifesto, as legal and historical argumentation, and as a searing indictment of white moderation.

Birmingham feels like an epistle. King writes from prison just as Paul did. He calls for action just as James did. He uses parables, references scripture—the letter is a theological argument for justice.

James warns against being hearers of the word but not doers. King warns against being sympathetic but inactive. Both essentially say: If you’re sitting on the sidelines, you’re not just failing to help—you’re part of the problem.

Also, that final section? “Never before have I written so long a letter... what else can one do when he is alone in a narrow jail cell, other than write long letters, think long thoughts and pray long prayers?”

It’s been a minute since the Bible has added any new texts, and I’m picturing a hypothetical New Testament Extended Edition, where Letter from Birmingham Jail is just another canonical epistle:

Paul writes to the Corinthians about love.

James writes to the church about living faith.

King writes to white moderates about the moral failure of neutrality.

Same energy. Same fire. The Bible could use another writer as surgically precise as King.

LAST WEEK IN THE STOCK MARKET:

🔮 Market Mayhem: The Economy’s Uncertain Future in the Shadow of Tariffs

The stock market continued its volatile streak as investors wrestled with the economic fallout of Trump’s newly imposed tariffs and mounting concerns about Federal Reserve policy. The S&P 500 fell 0.95%, the Dow Jones dropped 0.99%, and the Nasdaq slid 1.36%, extending last week’s turbulence. The Russell 2000 was once again the hardest hit, shedding 1.20% as small-cap stocks struggled under pressure from tightening financial conditions.

The markets are trying to find their footing, but the reality is clear: geopolitical uncertainty, trade war fears, and a stubbornly high interest rate environment are creating headwinds that traders can’t ignore.

Big Themes to Watch:

Trump’s Tarrifs: The Trade War Escalates

Over the weekend, President Trump officially introduced 25% tariffs on all steel and aluminum imports, with additional reciprocal tariffs expected to be announced by midweek. Unlike in 2018, when China bore the brunt of U.S. trade measures, this time Canada, Mexico, the EU, Japan, South Korea, and Brazil are in the crosshairs.Markets had largely priced in the possibility of tariffs, but the scope and speed of implementation sent a fresh wave of risk-off sentiment through equities. Canadian and Mexican currencies plunged, while U.S. manufacturing stocks with foreign supply chains saw heavy selling pressure. The economic fallout could be significant—Canada is now at risk of recession, and retaliatory tariffs from key trading partners could amplify the damage.

Higher Mortgage Rates Are Here to Stay

As if rising costs from tariffs weren’t enough, mortgage rates remain stuck near 7%, with the latest Fannie Mae survey showing a sharp decline in consumer expectations for rate cuts. Only 35% of respondents now believe rates will drop in the next 12 months, down from 45% in November. The real estate sector is feeling the squeeze—pending home sales dropped 5.5% in December, signaling that affordability concerns are keeping buyers on the sidelines.

For homebuilders and real estate investors, this means a longer period of higher borrowing costs and continued stagnation in transaction volumes. Cash buyers and institutional investors, however, may find themselves in a prime position to take advantage of the slowdown.

Looking Ahead: Brace for More Volatility

Between Trump’s tariffs, Powell’s rate strategy, and corporate earnings from McDonald’s, Coca-Cola, Cisco, and Shopify, this week will be another high-stakes battle for market direction. Investors are juggling multiple threats—higher-for-longer interest rates, rising trade tensions, and the potential for retaliatory tariffs—that could shape the market’s trajectory for months to come.

Question of the Week

🏝️If your tech stack had to compete on Survivor, which tool would win immunity, and which one would be the first to get voted off the island?

Steve Ponders the World:

A Desperate Attempt to Wrest Control Over Her Own Body

The push to control trans bodies is not a cultural anomaly but a continuation of a long-standing playbook: strip away rights, criminalize survival, and force the most vulnerable into underground economies just to access basic care. The New York Times editorial