Start with the Tumor, Not the Listicle

05/05/25 The Monday Blueprint: A literary callout, an economic reckoning, and why your credit card bill matters more than the Dow

A Letter to Mr. Crenshaw, In the Spirit of Mr. Alexander Pope

nec te vulgi dedere verbis, nec spem ponis in praemiis rerum1

Over the weekend, I tried reading Paul Crenshaw’s Stupid Shit People Still Believe.

Got halfway through and gave up, because—well—it was boring. Which really bugged me because Crenshaw isn’t some random Medium writer yelling about the deep state from his stepmom’s basement.

His work explores American identity, politics, memory, and he’s been published in Best American Essays, Oxford American, The Rumpus. He’s best known for blending memoir with cultural critique (yeah, I do that here too). There’s a Pushcart nomination, I think, and to the outside lit world, a Pushcart might seem prestigious, but a nomination is like a dandelion in spring. I mean, I have one.

The point is, Crenshaw has got some chops, he’s been around the block a time or two, and he should just fucking know better to write something like Stupid Shit People Still Believe.

So I was expecting more because if you’re going to ask people to wade through 6000 words of “what’s wrong with the world,” you better give them more than contempt and cleverness.2

Crenshaw starts by talking to the progressives, the so-called policy-aware, the angry-but-rational left. He sets his essay up as a rally cry, like we’re about to engage in a shared reckoning.

He spends the first six paragraphs recycling 2021 Twitter bait punchlines cataloging horse butt-holes, space lasers, and Hunter Biden’s dick along with flat-earthers, Holocaust deniers, and weather control conspiracy theorists. The tone is unbelievability and rage. And then, he writes,

I share these with you so maybe immigrants aren’t drowned in the Rio Grande, poor people can have health insurance, and trans people can live their beautiful lives without insecure men attacking them.

As if his rant earned those stakes, hoping we’d mistake invocation for conviction.

What drives me most nuts as a rhetorician is that this line is the narrative promise: your scope, your mission, your damn thesis.

Yet, the essay we’re given is a wrongly ordered listicle without scaffolding. Instead of beginning with drowned immigrants—the life-and-death stakes Crenshaw himself names—we’re dropped headfirst into culture war talking points repackaged as anti-LGBTQ outrage. We’re flung through a rushed tour of anti-immigrant history, a recycled Reagan-era anecdote about a welfare queen, a weed panic courtesy of Harry Anslinger, and a jazz tangent about Billie Holiday. Finally, like a late-stage confession, we get a complaint about prosperity preachers and Bible clobber passages.

The essay whiplashes cultural resentment dressed as critique.

And to top it all off? He never capitalizes Trump’s name.

This cutesy typographical rebellion deserves attention because somewhere in the middle of the essay, much like an undergrad trying out pastoral voice in his creative writing final, Crenshaw’s tone shifts to a soft moral sermon with low-key insults and callouts to the political right.

Crenshaw writes,

They’re lying to you about trans people…

They’re lying to you about bathrooms…

It’s meant to make you mad. To keep us separated….

Supposedly, the “you” is the misled centrist, or the low-information voter, maybe the swing-state uncle who still thinks Bud Light went woke. Except Crenshaw never writes as if those specific people are actually reading. He’s using “you” like a ventriloquist’s dummy, pretending to speak to an othered, manipulated audience. He means to sound intimate and urgent but never brings “you” close enough to be a conversation partner.

But then later, he writes,

I’m not sure how to explain to you that people who don’t have anything—who came here, in fact, because they have nothing—are supposed to be taking money away from you.

I also don’t know how to make you stop hating people. I don’t know how to get you to stop listening to the people telling you to be afraid and to start listening to the people telling you we can build a better world.

But mostly I’m having trouble reminding you that we were once immigrants…

These lines are not aimed at the progressive reader. Crenshaw breaks character and finally speaks to the very people he’s spent the last 10,000 words mocking.3 These moments feel real. They feel true. But they betray the rest of the essay’s structure because if Crenshaw were actually writing to the person who needs to hear this, then, well, the opening wouldn’t be six paragraphs of smug “look at these idiots” preamble.

And Mr. Crenshaw, this is the point where I’m directly telling you exactly how to make people stop hating, how to explain, and how to remind. Because you have it, right there in your essay, but maybe you’ve forgotten what kind of power you hold.

This right here, this is what you wrote and glossed over:

...after a lifetime of drinking and smoking, doctors found the first of two tumors on my kidneys and I finally quit drinking. After the opioids ran out from the first surgery, I went through withdrawal. Black days unlike anything I’d ever experienced before. I didn’t even know what was wrong, just that I needed something. I lay in darkness crying for relief. I considered drinking again, just to kill the pain.

When the cancer came back—nausea and vomiting and no appetite at all—cannabis kept me from withering away. It was the only non-opioid that offered me any relief at all. I had to drive to another state to take it because my state senator, Roger Marshall, won’t allow even medical marijuana in Kansas.

That is pain. That is sorrow. And that is raising yourself back up. Politically, whether I’m pro-cannabis or not, that’s a story I want to hear. That’s the voice I’d sit across from, coffee in hand, and say: “Tell me more,” because that’s the most powerful, most honest part of your entire essay.

Mr. Crenshaw, why the fuck did you not start your essay there? Because if you haven’t forgotten—if this was all intentional—then God help us. Because that means you chose the applause over the risk. The listicle over the letter. And you know better. Because the risk, the personal, the share, the story is what transcends and builds connection and gets people to stop hating.

But I also gotta tell you, it’s not just Stupid Shit People Still Believe. Because if you were really trying to persuade the misled, then you owe your audience more than scorn and a lower-cased Trump.

The literary machine that rewards this kind of rage-without-risk, the editors who call this kind of polemic “searing,” the readers who repost with a fire 🔥 emoji like that counts as solidarity, the MFA-washed circles that mistake clever arrangement for moral clarity, the cadence of conviction without consequence… and we’ve deemed this genre “speaking truth to power.” But we’re just yelling at shadows. Pope had stakes. Swift had stakes. Joan Didion always had stakes. We, as the 21st Century literary community, need to do better than facts and a sneer.

So, Mr. Crenshaw.

Paul—can I call you Paul?

I’d challenge you. Rewrite your essay. So that it matters.

OFFICE HOURS

I’ll be holding open office hours this Tuesday at Breakaway Café from 10 AM to 1 PM. Schedule something official—or just walk in, grab a coffee, and drop into the chaos with me.

Let me be your first phone call. Or just come grab a coffee. No pressure. No sales. Just an open seat—and a one-on-one strategy session to help you figure out your next move.

LAST WEEK IN THE STOCK MARKET:

The Floor is Lava (and Your Shoes Are Made of Debt)

We’re now in the awkward stage of pretending the fall is part of the choreography. The market tried to stand straight this week but immediately wobbled like a baby deer on an ice rink.

Futures are red across the board—again:

S&P Futures: 5,663.50 (▼ -0.80%)

Dow Futures: 41,126.00 (▼ -0.73%)

Nasdaq Futures: 20,026.00 (▼ -0.84%)

Russell 2000: 2,004.70 (▼ -1.09%)

Even the VIX dropped 7.80% to 22.68, which is either a sigh of relief or a nervous breakdown in disguise. Meanwhile, gold climbed to $3,267.40 (▲ +0.74%)—a glittering middle finger to anyone still saying "soft landing."

Earnings season is still in swing, and the split-screen is real:

Top gainers were heavy in ed-tech and AI: Duolingo (▲ +21.6%), Pony AI (▲ +21.5%), and iRhythm (▲ +20.75%). Apparently, we’ll all be learning Mandarin while monitoring our irregular heartbeats with machine learning.

On the loser board: Westlake Corp (▼ -13.46%) and Cytokinetics (▼ -12.98%) got flattened like they bet on the wrong apocalypse.

The Magnificent Seven?

NVIDIA and Palantir are clawing their way back (+2.6% and +6.95%, respectively). Tesla’s up too (+2.38%), but Apple took a hit (▼ -3.74%)—proof that even the fruit falls hard.

Bottom line:

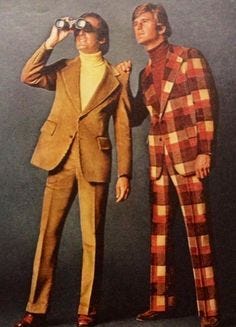

Markets hate uncertainty, and right now we’ve got plenty: Fed policy, inflation stickiness, tech whiplash, global instability, and whispers of stagflation creeping back like a 1970s polyester ghost.

Big Themes to Watch:

1. CEOs Are Sounding the Alarm—Even When the Numbers Don’t

From Exxon to Eaton to Apollo, executive suites are suddenly filled with tariff talk. Publicly, the earnings look solid. Privately, the margins are cracking. Tariff exposure is the new earnings hazard, and the smartest leaders are getting loud before the analysts catch on. This isn’t guidance—it’s a warning shot.

➡️ Watch for: More CEOs referencing “uncertainty” and “cost controls” in earnings calls. Sectors with international exposure (manufacturing, energy, tech) getting jittery. And quietly delayed capital projects that don’t show up in the data—until the layoffs hit.

2. The Tariff War Is Turning into a Currency Cold War

China’s not just retaliating with matching tariffs—it’s reshaping the battlefield. By quietly exempting key U.S. goods and subsidizing internal production, they’re buying time while weakening U.S. influence abroad. This isn’t just trade. It’s leverage, layered.

➡️ Watch for: Accelerated yuan adjustments. Emerging market currencies in freefall. U.S. exports to China shrinking despite headline “exemptions.” And Beijing’s AI, chip, and pharma investments quietly overtaking global share.

3. Oil's Not Crashing—It’s Trying to Say Something

Prices keep dropping, but no one’s celebrating. OPEC+ is increasing supply because it has to. U.S. production is quietly pulling back. And geopolitical risks are piling up like dry tinder. This isn’t normal softening—it’s a slow-motion breakdown in coordination and pricing power.

➡️ Watch for: Oil hovering near or under $55 before a whiplash rally. Refiners cutting capacity. Russia and Iran headlines driving outsized swings. And U.S. energy stocks diverging from crude prices.

4. The Fed’s in a No-Win Box—and Everyone Knows It

The data says “hold.” The markets say “cut.” Trump says “NOW.” Powell’s trapped between inflation risks and political pressure, and everyone from the ECB to Brazil is acting first while the Fed blinks. What’s at stake isn’t just interest rates—it’s the Fed’s credibility.

➡️ Watch for: Powell press conferences loaded with evasive language. Rate-cut expectations swinging wildly with each jobs report. And quiet Fed leaks testing market reactions before any official move.

Looking Ahead:

1. May 7—Consumer Credit Report: Debt’s Dirty Little Secret

Tuesday’s numbers will tell us how much U.S. households are relying on plastic to keep up the illusion of stability. With wages flattening and costs creeping, revolving credit is starting to look like the nation’s favorite side hustle.

2. May 9—Initial Jobless Claims: The Canary Update

Thursday’s weekly claims are getting twitchier. Last month’s surprise uptick might’ve been a fluke—or it might be the first flutter before a broader labor pullback. One more climb, and the “no-recession” crowd will have a harder time keeping a straight face.

3. May 15—CPI and Retail Sales: The Real Inflation Gut Check

Next Wednesday delivers a one-two punch: headline consumer prices and retail sales. If CPI jumps, it’ll confirm what your grocery cart already told you. However, retail sales could tell the deeper story—whether people still spend despite higher prices or finally pull back. Watch for cracks in discretionary sectors like apparel, electronics, and dining out.

4. May 22—FOMC Minutes: What Powell Really Meant

Two weeks after the press conference, we get the receipts. These minutes will show what the Fed was thinking behind closed doors—and whether anyone in that room is quietly freaking out about sticky inflation, softening labor, or political interference.

OUR FEATURED BUSINESS

Latin is easy, go do a Google Translate or read Epistle to Dr. Arbuthnot.

We’re only at 1200 words here, so stick with me. You’ll get through it, I promise.

His essay is not that long, liberal use of hyperbole here, cause I can.