The Machine Was Hungry

Turns out, I was the problem. Also, college grads are broke without a job, hedge funds are twitchy with a side of too spicy salsa, and the only thing working harder than my dad is an automated saw.

The Last Job My Father Understood

New Knoxville, Ohio, population 905, up by 50 people the year I graduated in 1991. I don’t think my hometown could be smaller. The place consists of a single building school that houses kindergarten through senior high, a post office, a gun club, and when I was a kid The Party Shop that sold beer, pizza, and rounds of pinball games. The town breathed basketball and sawdust.

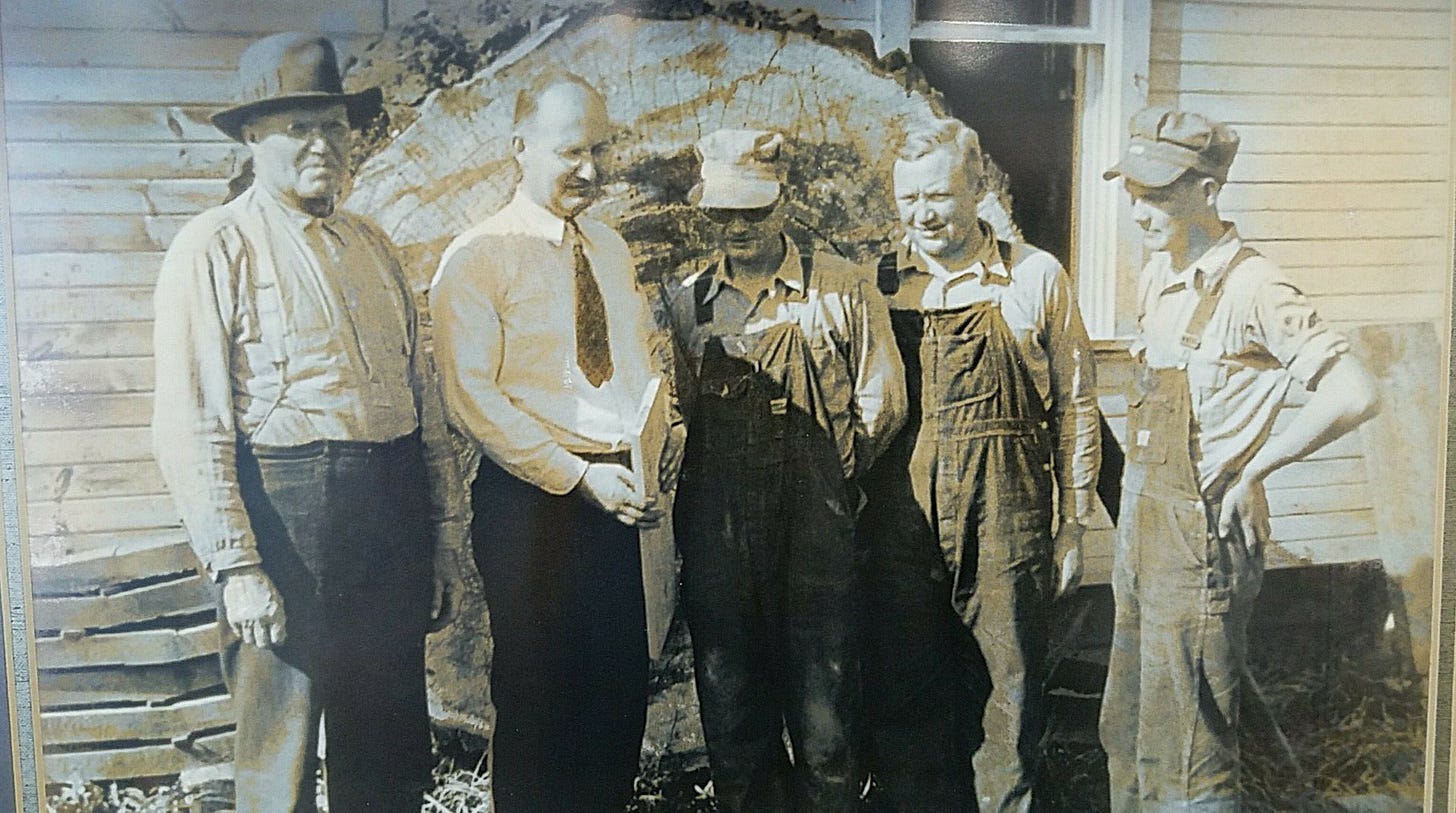

You drive past the school just a little, and you come up against a gas station/convenience store where the town bully swung me around by my ankles, and a little farther along, you come to Hoge Lumber Company, where my dad used to work, and before him, my grandfather. And in 1992, I started work there too.

The last thing I wanted to do at 19 years old, having fully flunked out at Bowling Green State University, was to work at Hoge Lumber Company. When I was hired, a lot of the floor guys who ran the saws ganged up on me, showed me a board and asked if I knew what was wrong.

“No idea,” I said.

“We cut it too short,” they said. “We want you to go get the board stretcher.”

“Where’s it at?”

“In the grading shed.”

I nodded and took off.

The grading shed was where my dad used to work. Hoges sent him to grading school in Tennessee, where he learned how to grade the quality of lumber, which dictated whether the board was going to be shaped into regal staircases or turned into number two pencils. Or just straight up firewood.

My summers between high schools were spent driving all over southern and eastern Ohio with Dad to these backwoods family sawmills. At fourteen, I maneuvered giant diesel forklifts. Though we were shortly taken off forklift duty cause my thirteen-year-old brother liked to go take the machines mudding after a heavy rain. Monday through Saturday, we’d wake at 5 am, drive an hour with Dad to a sawmill and stack lumber from 6 am to 9 pm, and for lunch, he’d take us to some greasy spoon diner. Or, when we were really out in Timbuktu, cold bologna sandwiches, my mom had packed the night before.

Dad had one rule when we worked at the sawmills. Or maybe it was an idiom? “If it’s thirty below out, and you don’t have sweat running down the crack of your ass, then you’re not working hard enough. That’s what my father taught me, and that’s what I’m teaching you now. It’s the only way to get ahead in life.”

When Dad graded lumber at Hoge Lumber Company, I was about three years old, John Hoge put him in the grading shed, and when an employee got sent to the grading shed, they were being punished for being a screw up at work. Because Dad didn’t believe in fifteen-minute breaks or even sometimes lunches.

When I worked at Hoges, the guy who ran the grading shed, was a soft-spoken rotund lifer everyone called Turtle. So ideas about how to do work had drastically changed since my dad’s days.

Anyway. I guess the floor boss had been looking for me for about three days because I’d been off that long looking for the board stretcher ‘cause they kept sending me to look for the damn thing.

“Don’t you know who he is?!” The floor boss screamed so hard at the other employees that spit sprayed out through his clenched teeth. “He knows there’s no such thing as a g’damn board stretcher.” And I sure did know what a board stretcher was, because I hung out behind the grading shed in the good shade for about three days, reading comic books.1

The job no one wanted was the round table. And that was my punishment for hiding out for three days.

Thirty table saws lined up one right behind the other. At the far end of the factory floor, processed maple timbers turned boards float down conveyor belts to the saws. The saw operators chopped the knots out of the lumber. The sawdust and knots dropped into a waste conveyor belt that took that traveled to the boiler, which turned a bunch of water into steam, which provided electricity for the entire town.2 The good pieces were moved forward and dropped onto a huge, steel gray metal rotating round table. My job was to pull the blocks from the spinning pile and stack them according to length.3 Once a stack was built, I’d strap it all together for shipping to China, where they’d turn blocks into bowling alley lanes.

About a year later, John Hoge brought in a computerized saw. They positioned me at the end of the machine, right where a metal chute spat out blocks. Same job: stack by length, strap for shipment. Two guys fed the machine, shoving lumber into its teeth. The computerized saw had been made in Germany—precision steel, blinking lights, a humming little console. Once a month, the company flew out techs from Germany to figure out what was wrong with the saw, because the computer kept breaking down. And when the computer glitched, they fired up the old manual saws again.

It took my dad a year to ask me how I liked Hoge Lumber Company. “Does Virgil still work there?”

“Yeah,” I nodded. “Virgil still works there.” But I also told him that this computerized saw they brought in keeps breaking down, and sometimes I’m waiting for it for hours on end, half days, full days. Sometimes, a whole week, those guys just trying to figure out how the computer works.

“Well, you know computers,” Dad said.

“Yep,” I said.

“I bet you could run it.”

“Yep.”

Couple days later, the Executive Vice President marched out to the floor boss. For a town of just under 900 people, the EVP was the only person I knew who wore a three-piece suit. From a distance, I saw the EVP pointing at me and pointing at the two guys who ran the computerized saw, and then pointing at the computerized saw. Next thing I knew, the floor boss was spitting tobacco juice on the ground and telling me I was running the saw that day, and the other two guys were stacking blocks.

So I ran the saw. I ran the saw from the perspective of someone who believed that if it was thirty below out and you didn’t have sweat running down the crack of your ass, then you weren’t working hard enough, except this wasn’t manual labor anymore. I had a console and a computer, and all I had to do was feed the machine lumber.

And the machine was hungry.

There was nothing ever wrong with the computerized saw. It worked just fine. And the two guys at the end of the chute were buried in blocks—took two days of stacking to catch up to what that saw accomplished in a single eight-hour shift.

The floor boss took me aside after that single eight-hour shift. He took me by the shirt collar. “Look,” he said, “I don’t know what you’ve been telling your dad, or what your dad has been talking about with the EVP, but you’re never going to run that machine again, and you’re never going to complain about it ever again either, you hear me?”

I was confused.

“Don’t you get it?” He pointed at the thirty manual saws. “That machine, the way you ran it today, that replaces sixty workers.”

It was in that moment I realized our nation's economy had completely shifted, or was about to dramatically shift within my own lifetime, into something where labor no longer equals production and production no longer necessarily equals value.

That was thirty years ago standing on that precipice, sawdust in the air, the ghost of my dad’s work ethic on my back. I didn’t have the words then the words to describe what I exactly felt that day. I just knew the saw worked, and that scared the hell out of everyone.

CHANGES TO COFFEE WITH STEVE

Over the past couple of weeks with a lot of deep-hearted thinking, the shape of Coffee with Steve is changing.

You’ll still get your regular rhythm:

The MondayBlueprint

GratiTuesday (returning this week!)

Wicked Moxie

The Friday Footnote

The Saturday Rundown

And that’s your free tier and will always continue to be free.

But Paid Subscribers now get access to an Exclusive Brew—fiction in progress, tarot essays, longform cultural critique, and work I don’t share anywhere else. This stuff is sometimes behind the scenes, unpolished ideas in formation: drafts, process, power.

We’ll also be launching a new off-site invite-only Workshop Circle, which, if you’re a paid subscriber, you will get an invite. But staying in the Workshop Circle means showing up. Monthly feedback required. So if you go quiet, the door closes.

And if you want to go deeper…

Check out the yearly founding member tier.

This isn’t a premium subscription.

You don’t get anything extra—no bonus perks, no secret handshake—just the same full access as the monthly and annual plans.

But this tier?

It’s for those who believe story shapes culture.

Who want to see fiction, civic truth, and sacred process thrive.

This is about backing vision.

Fueling the work that always matters.

And carrying the torch alongside me, not just watching from the crowd.

If that’s you—

Welcome in.

LAST WEEK IN THE STOCK MARKET:

TACOs might be off the menu in D.C., but Wall Street’s still choking on the salsa with a mouthful of hot sauce and regret.

Markets stumbled into Monday like they just remembered who’s president. Despite May closing with historic highs—S&P’s best May since 1990, Nasdaq’s since 1997—June opened with a slap from tariffs, a VIX jolt, and grim undercurrents in the labor market.

S&P Futures: 5,889.75 (▼ –0.44%)

Dow Futures: 42,138.00 (▼ –0.37%)

Nasdaq Futures: 21,250.25 (▼ –0.59%)

Russell 2000 Futures: 2,059.50 (▼ –0.43%)

VIX: 19.84 (▲ +6.84%)

Gold: $3,371.40 (▲ +1.69%)

Trump’s promise to double tariffs on steel and aluminum to 50% reignited U.S.-China tensions, triggering sharp futures pullbacks and a fresh round of investor indigestion. Hedge funds still bought the dip, but let’s not confuse a reflex for a signal.

Meanwhile, the labor market’s clean face hides a cracked foundation: recent college grads are struggling hard. That generational fracture is now visible in the data—5.3% unemployment for grads vs. 4.2% nationally. Even Dunkin' isn’t hiring. (Trust me, I asked.)

Top gainers rode a high-voltage jolt of biotech chaos, beauty retail resilience, and EV-fueled hype: Lyell Immunopharma (▲ +2,074.80%) exploded on what smells like a reverse split or maybe just the lingering funk of meme-stock carnitas. Regencell Bioscience (▲ +18.36%) kept its biotech mystique alive, and Ulta Beauty (▲ +11.78%) proved that in a shaky economy, mascara still moves units. Sprinkle in Pony AI (▲ +12.30%) and MP Materials (▲ +10.22%), and you’ve got a strange all-you-can-eat taxo bar—half-lab grown adrenaline, half mall food court delusion in a Doritos shell.

Big-time losers bled across biotech, apparel, and semiconductors, with Summit Therapeutics (▼ –30.50%) face-planting after what was likely a clinical setback, Gap Inc. (▼ –20.18%) unraveling faster than its denim inventory, and Regeneron (▼ –19.01%) taking a brutal tumble—possibly from earnings, litigation, or just a rough news cycle. Rounding out the list were Ambarella (▼ –15.10%) and Cooper Companies (▼ –14.61%), casualties of tech contraction and medical device drag. A rough morning for the “defensive growth” crowd.

Bottom line: Markets are high on hopium but choking on volatility fumes. May was mirage—lifted by AI mania, tariff flip-flops, and hedge fund pile-ons. But June’s cold open includes returning tariffs, thinning job growth, and even entry-level service work isn’t a safety net anymore. If you're an investor, probably don’t chase the May high. If you're a policymaker, please look past the headline numbers. And if you're a parent watching your kid get ghosted by Dunkin: you’re not imagining the squeeze.

Big Themes to Watch

1. Tariff Theater Is Back—And This Time It Might Stick

Trump’s tariff threats used to be background noise. Now they’re cutting through. The so-called “TACO trade” (Trump Always Chickens Out) is cracking under pressure. He’s doubling down on steel and aluminum. China’s retaliating. The appeals court is letting it all hang while legal chaos brews beneath.

➡️ Watch for: Bond yields reacting faster than equities. Gold surging on safe-haven demand. And midsize manufacturers quietly slashing guidance before Q3 even starts.

2. Labor Market Is Strong—Unless You’re 22

Headline jobs numbers still look healthy, but zoom in and the cracks are obvious: college grads are facing 5.3% unemployment and a hiring environment frozen by AI and corporate caution. Even Dunkin’ is ghosting applicants, according to my recent college graduate daughter. One friend of mine said their kid submitted 62 applications before being hired.

➡️ Watch for: Youth joblessness as a canary. Declines in entry-level postings. More companies hiding hiring freezes behind vague “efficiency” language.

3. Hedge Funds Are Buying the Dip—But It’s a Nervous Tick

May’s sugar high was driven by AI euphoria and tactical hedging—not conviction. Hedge funds piled in at the fastest pace since Nov 2024, but positioning looks reactionary, not strategic. Think dopamine, not discipline.

➡️ Watch for: Short-lived surges in tech. Liquidity draining faster on bad news. And retail traders left holding the bag as institutions sneak out the side door.

4. Gold’s Halo Is Back—For All the Wrong Reasons

The VIX popped. The dollar dipped. And gold is quietly making its move—up 1.69% this morning, +25% YTD. This isn’t inflation hedging—it’s panic polish. From drone strikes in Siberia to tariff tremors at home, geopolitical anxiety is once again the best ad campaign for bullion.

➡️ Watch for: Crypto staying flat while gold rallies (narrative shift). Increased ETF flows into GLD and IAU. And central banks making quiet buys that scream long-term distrust.

5. Big Tech’s Glow-Up Masks a Splintered Economy

The “Magnificent Seven” are printing earnings and dragging the indices with them. But consumer discretionary stocks are flailing, small business optimism is tanking, and IPOs are only working if your name is Chime or Voyager. We’re not in a bull market—we’re in a Taco Bell economy—if you don’t look too close, it tastes like growth.

➡️ Watch for: Further divergence between mega-cap tech and everything else. Increased layoffs in service sectors. And Powell’s crew walking tightropes in their Beige Book language.

Looking Ahead:

June 5 — JOLTS Job Openings: Ghost Town or Gold Rush?

The Job Openings and Labor Turnover Survey (JOLTS) will show if employers are still hiring or just posting fake job ads to look busy. A big drop below 7 million? That’s a red flag. Stability? The “soft landing” myth lurches forward. But either way, grads aren’t feeling it—expect this to sharpen the generational divide in the job market narrative.

➡️ Watch for: Job openings-to-unemployed ratios. And CEO spin about “hiring pipelines” when really, no one’s calling back.

June 6 — ADP Employment Report: The HR Whisperer

This private-sector payroll read is often the messy cousin to nonfarm payrolls, but this week, it matters. The Fed’s looking for softness without slippage. Too hot, and “higher for longer” gets re-inked. Too cold, and you’ll hear recession bets getting placed in real time.

➡️ Watch for: Big gaps between small business and large-cap hiring. And sector divergences—if construction or retail freeze, it’s game on.

June 7 — Nonfarm Payrolls: The Fed’s Tarot Card

This is the week’s boss-level event. Expectations are already low: 130K jobs added and unemployment flat at 4.2%. But the real action is in wage growth and participation. Anything that smells like stagflation—low hiring, high wages, flat hours—and the Fed’s going to need a stronger potion than “data-dependent.”

➡️ Watch for: Average hourly earnings and labor force participation. Also: revisions. They’ll be buried in paragraph four, but they matter more than the headline.

Any Day — Trump’s Tariff Noise + Xi Call = Chaos Bingo

Trump claims he wants to talk to Xi. China’s Ministry of Commerce says the US violated the deal. Meanwhile, we’ve got steel tariffs set to double, semiconductor bans under review, and a federal court ruling waiting to detonate. At this point, the markets are pricing tone shifts.

➡️ Watch for: VIX spikes on offhand tweets. Commodity moves (especially copper and palladium). And another round of the “TACO trade” getting re-priced in real time.

OUR FEATURED BUSINESS

Later that summer, I caught a wood chip in the face. The planer had jammed. The only way to fix it was to shut off the blades, unplug the machine, wait for everything to stop spinning, and lean in to see what was caught. You’d find the jammed chip, take a stick, and poke at it until it came loose. So me and the guy I was working with both leaned in. What he didn’t tell me—or anyone—was that when he was done looking, he went ahead and fired the machine back on. The chip caught me just above my upper lip. If you pulled the skin apart, you could see straight through to my teeth. The floor boss told me to clock out once the ambulance arrived, or he could patch it with some glue and duct tape, and I could keep working; my choice.

It was a tidy, efficient system—until the EPA stepped in. Rumor was that Dayton Power & Light, expanding fast, didn’t want Hoge’s generating their own power. Shutting down the local power plant would let DP&L scoop up all 900 residents of New Knoxville as customers. You can check out the lawsuit here.

One night, we grabbed Eric and Saran Wrapped him up, stuck him in a stack of tires we’d piled up in the middle of the round table, and left him there spinning the entire night round and round. He did really weird things we weren’t all that okay with, but let slide—like the Nike shoebox filled with raw liver that he’d heat just slightly in the microwave, and then…well, he had a hole in the side of the box. And you get the idea. Except, when he started talking about his niece in the same way he talked about that shoebox. The round table seemed like justice.

3a. Dad’s generation wasn’t much better. They took turns bringing in donuts every morning.

Except this one guy never brought any donuts, and always ate the crème-filled Long Johns. So one morning, they made sure to bring in only one Long John, and someone introduced that donut to the oil gun. He took a bite and started yelling, “My teeth! My teeth!” Then ran out saying he had to go home and brush his teeth.